AI-Powered Underwriting

for Faster, Smarter Deals.

Streamline your credit process with an intelligent platform built by dealmakers, for dealmakers. Accelerate pre-screening and underwriting with Wall Street-caliber AI and curated tools.

This simply helps us close more deals, faster. I can attest that it saves us more than 50% on production time than other forms of credit memos. We strongly recommend the PerCina Report solution.

Micah Thompson

President and Founder, Cape Commercial Finance

Transform Your Underwriting Workflow

PerCina Report simplifies complex deal analysis,

empowering your team with unprecedented speed and accuracy.

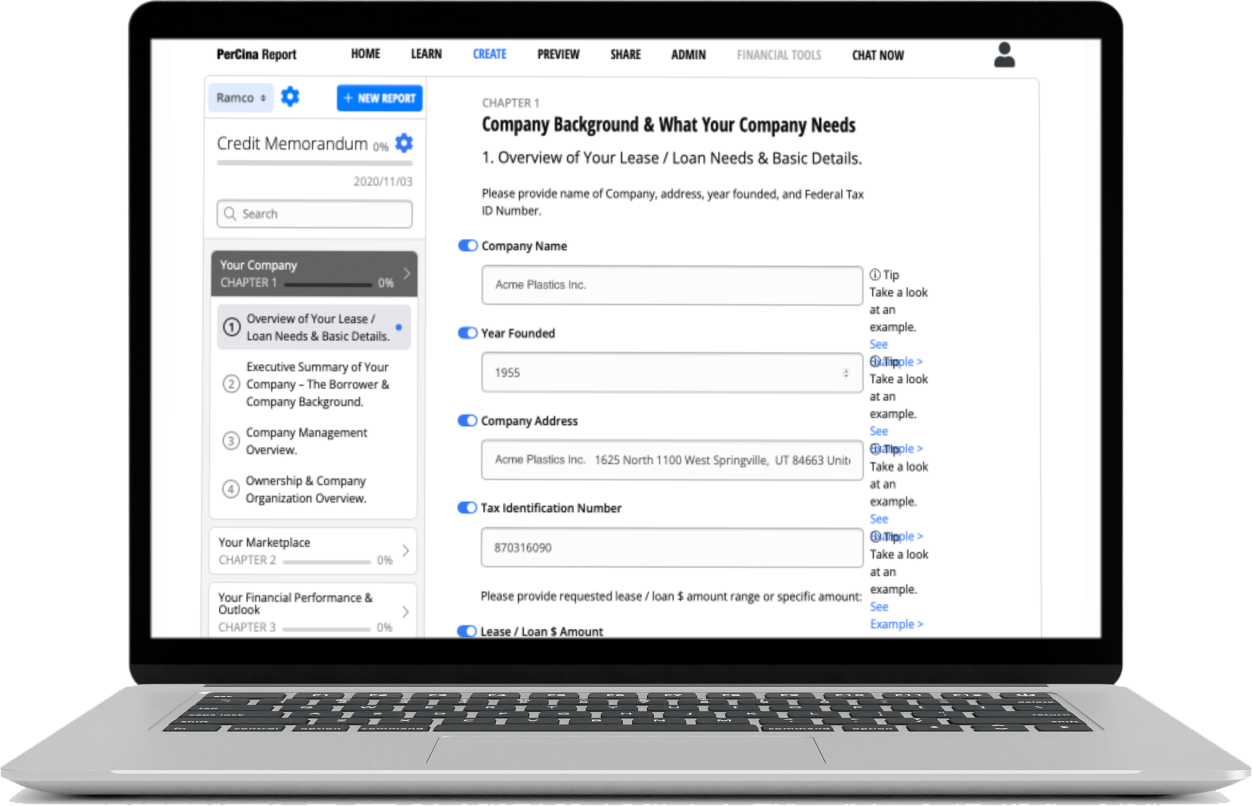

Private Company Report Generator

Generate comprehensive 25+ page deal prescreens or full credit memos in minutes. Our AI Credit Assistant leverages embedded expert credit questions, ensuring thoroughness and accuracy (no made-up answers).

Rapidly initiate deals with expert-level drafts.

Dynamic Querying & Editing

Collaborate with your AI Credit Assistant to dig deeper, ask specific credit questions, or refine your memo.

Enhance analysis flexibility and customize every underwrite.

Financial Data ReportSync - PerCina Labs

Upload spreadsheets, financials, and documents securely. PerCina quickly summarizes key data, saving hours of manual review.

Gain faster insights from large datasets, privately and securely. Perfect for private company data.

Instant Collateral Valuation

Access a vast database covering 10,000+ manufacturers and hundreds of asset types. Our Equipment Value Forecaster provides immediate collateral values and detailed asset information.

Confidently assess collateral coverage throughout deal terms

Ready to Transform Your Underwriting?

See how PerCina Report can empower your team and streamline your deals.